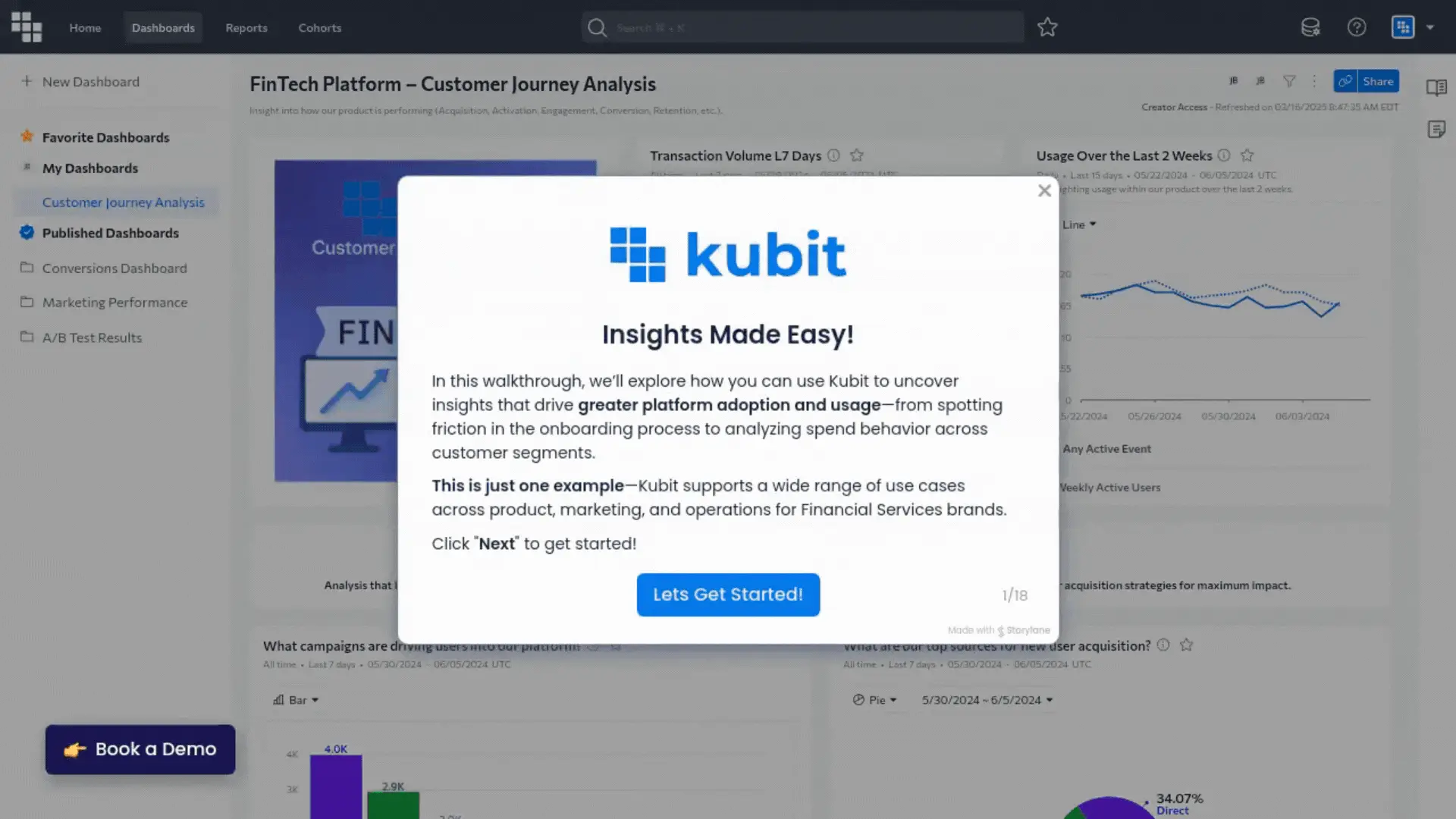

KUBIT FOR FINANCIAL SERVICES

with AI-powered analytics

Kubit activates customer journey analytics directly from your data warehouse, so you can reduce friction, accelerate time-to-value, and drive product adoption.

Optimize your finance platform with self-service insights straight from your data warehouse. No coding or data duplication.

Equip your entire team with exploratory analytics to maximize growth and improve the user experience. No learning curve.

Maintain full control with analytics that run directly from your data warehouse. View the SQL behind every report.

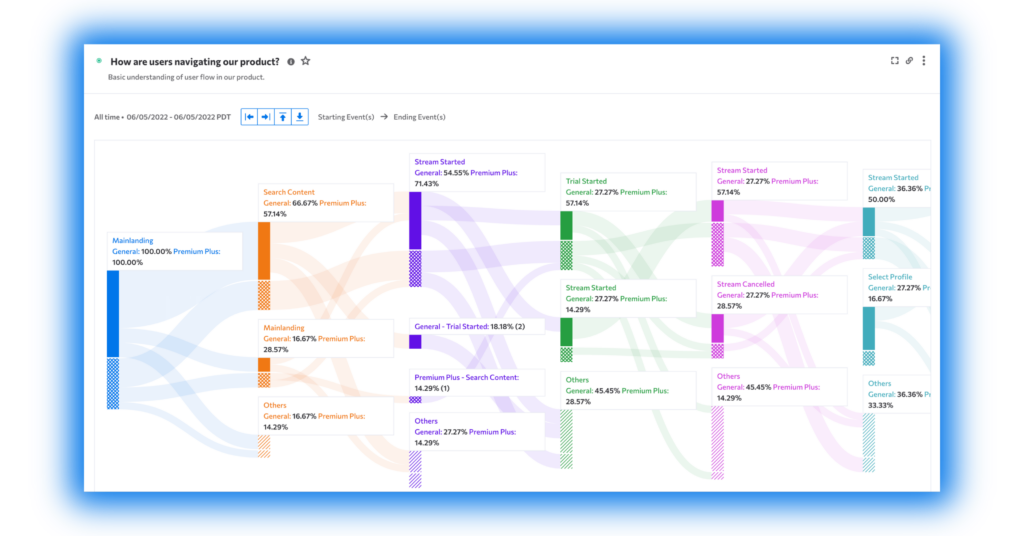

Path to Key Engagement

Gain insights into the journey users take toward completing a critical financial action—such as issuing their first virtual card, sending their first invoice, or connecting a bank account.

Measure how effectively your platform converts new signups into active users, track user behavior—and pinpoint where and why users drop off along the way.

Cohort your users by behavior to gain insights, deliver targeted campaigns, and drive retention. Compare user flows and identify actions that accelerate time-to-value or cause friction.

Analyze time-to-conversion and uncover key behaviors that predict upgrades, enabling you to optimize onboarding flows, boost activation rates, and increase customer LTV.

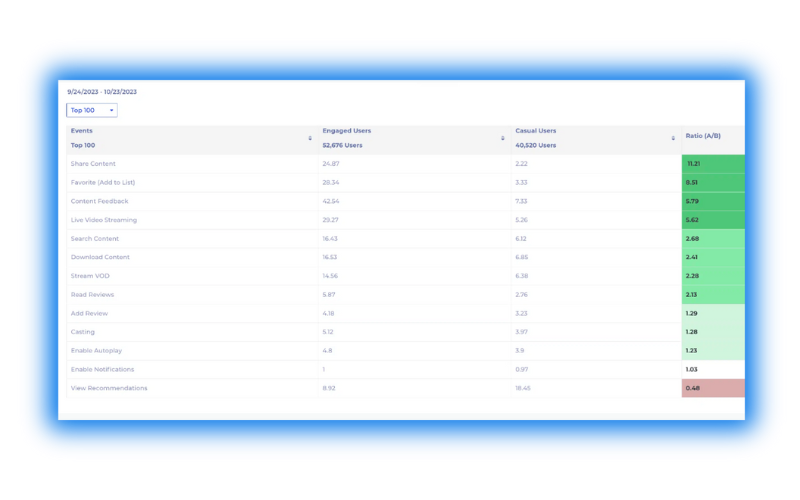

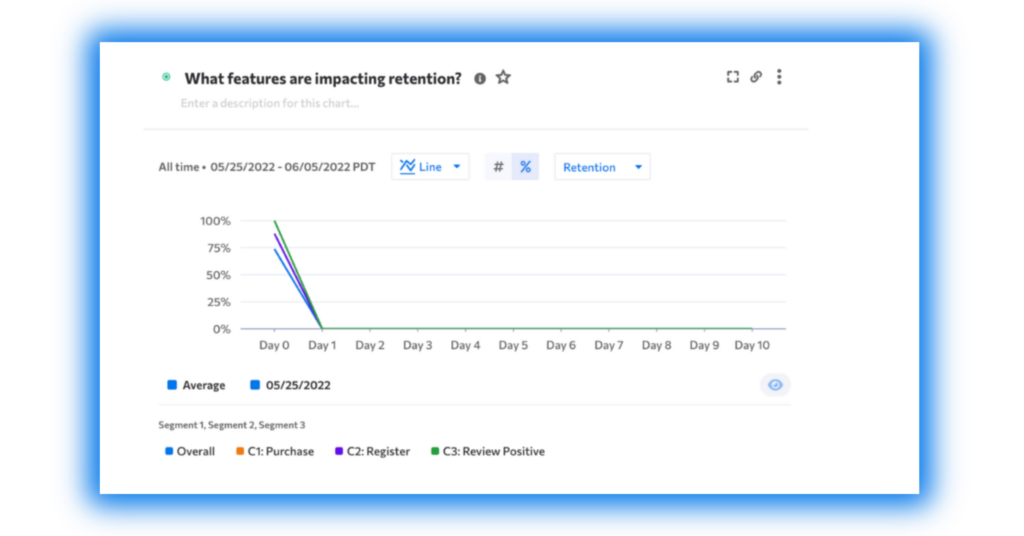

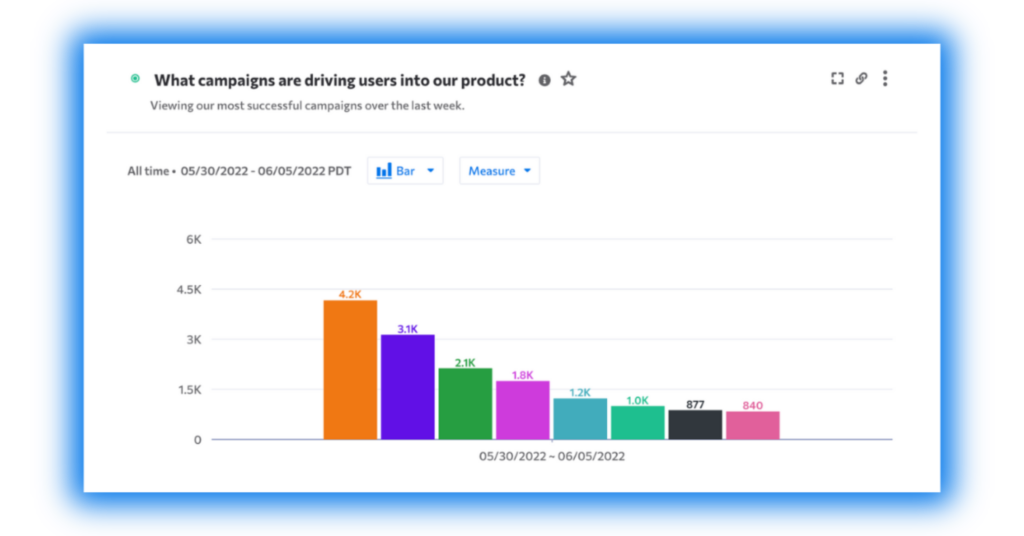

Measure Feature Performance

Understand which tools and features are most used across your customer base. Identify patterns among high-value users and optimize your product roadmap based on real engagement.

Identify which marketing channels, promotions, or product features drive signups and conversions. Understand what resonates—and what correlates with long-term retention.

“Kubit provides AI-powered customer journey analysis, directly from the data in the warehouse. It puts the different customer touches of the whole team into one place, which leads to a comprehensive picture of the customer’s interactions with us and their corresponding decision-making.”

CFO

Leading Finance Brand

“With Kubit, we’re enabling self-service analytics and giving our Data Team a better experience — with a faster turnaround to insights.”

Felipe Leite

Data Product Manager

“With Kubit, if I have a question pop into my mind about user behavior, within a minute or two, I can get an answer.”

Randall Britten

Senior Data Scientist

“Kubit has reduced the workload of my team. It’s so nice to have a truly self-service tool, one where we can teach the Product Managers ‘how to fish,’ so they can then work on their own—whether that’s monitoring certain activities by themselves, or digging into specific user actions.”

Isabella Poleo

Senior Product Analyst

Download our latest guide to explore how leading Financial Services brands leverage self-service, full-funnel analytics to track engagement, pinpoint drop-off points, and maximize customer retention.

Product

Pricing

Comparisons

Solutions

Integrations

We use cookies to enhance your browsing experience, serve personalised content, and analyse our traffic. By clicking “Accept”, you consent to our use of cookies.